You are here

GATA in the Press

New African Magazine - Arm-Twisting Africa

Submitted by admin on Sat, 2001-12-01 03:00 Section: GATA in the Press...Startling revelations at the GATA African Gold Summit in Durban. Story by Adam Hamilton.

Go on, ask the question: (from left) Ghana's JJ. Kufuor and South Africa's Thabo Mbeki whose economies have suffered greatly from the rigging of the gold market, are yet to publicly demand a stop to it

While the gold price appears to be calm and placid on the surface, powerful forces war behind the scenes to shape it. The stakes are stupendously high, as the state of the gold market and the price of gold do not exist in a vacuum. Virtually every important capital market in the world, from the mammoth currency foreign exchange markets to the critical international bond markets, is affected directly or indirectly by the price of gold.

New African Magazine - Mine all mine

Submitted by admin on Sat, 2001-12-01 03:00 Section: GATA in the PressPusch Comey, the prodigal son, returns home with one of the biggest stories of the year he forgot to report - GATAs all revealing gold summit in Durban on 10 May. It is worth every ounce in gold.

Fairtrade?: the fate of gold is in the balance as Western governments and finance houses manipulate the market

Things are happening to Africans that Africans don't understand. The economy suffers without explanation. There are constant layoffs of mine workers in Africa with tremendous consequences - economic turmoil in towns, villages and families. The spin off is crime, poverty, despair, and disease, which are all blamed on a "hopeless continent" that cannot take care of itself.

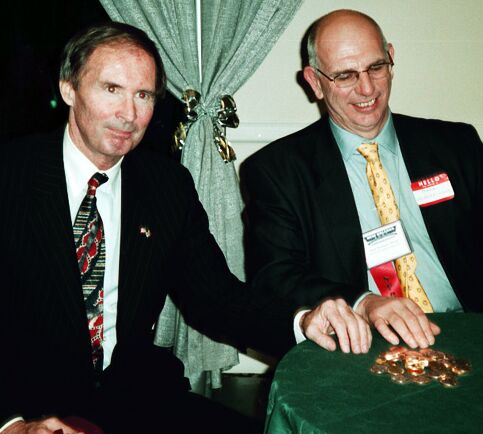

Photo: GATA Chairman Bill Murphy and Durban Roodeport Deep CEO Mark Wellesley-Wood

Submitted by admin on Thu, 2001-11-29 03:00 Section: GATA in the Press

GATA Chairman Bill Murphy, left, and Durban Roodeport

Deep CEO Mark Wellesley-Wood inspect the 30

1-ounce South African Krugerrand gold coins presented

by Durban as a contribution to GATA at the New Orleans

Investment Conference on November 29, 2001.

Lawsuits Continue To Pursue Summers After Leaving D.C. - Crimson Online

Submitted by admin on Fri, 2001-08-17 03:00 Section: GATA in the PressLawsuits Continue To Pursue Summers After Leaving D.C.

By DAVID H. GELLIS

Crimson Staff Writer

Currency bearing University President Lawrence H. Summers' signature isn't the only lingering reminder of his time as Treasury Secretary. This week, a U.S. District Court judge in Boston scheduled an October 9 hearing on a motion to dismiss a lawsuit that names Summers as a defendant.

The suit is fallout from Summers' time as a public official—and only one of many suits targeting him.

GATA Says Much of U.S. Gold Reserve is Encumbered - CBS MarketWatch

Submitted by admin on Wed, 2001-08-15 03:00 Section: GATA in the PressDALLAS, Aug 15, 2001 (BUSINESS WIRE) -- "Hard as it is to fathom, it appears that much of America's gold is essentially gone or in severe jeopardy," says Gold Anti-Trust Action Committee Chairman Bill Murphy.

Murphy points to an astonishing discovery by GATA consultant James Turk in his new essay, The Mystery of the Disappearing SDR Certificates, published at the GATA Internet site, www.GATA.org. An SDR, which is acronym for Special Drawing Rights a.k.a. 'paper gold,' is a monetary instrument issued by the International Monetary Fund, representing special drawing rights for one 35th of an ounce of gold.

Top Fed Lawyer Says '95 FOMC Transcript Misquoted Him. - By Joseph Rebello - Dow Jones Newswires

Submitted by admin on Mon, 2001-07-23 03:00 Section: GATA in the PressA top lawyer at the Federal Reserve has disavowed remarks attributed to him about the U.S. Treasury's use of gold swaps in foreign economic bailouts and currency-stabilization efforts, saying he was misquoted by the central bank's transcribers.

Virgil Mattingly, general counsel to the Federal Open Market Committee, wrote Fed Chairman Alan Greenspan last month that he couldn't recall making the remarks attributed to him in transcripts of a January 1995 FOMC meeting. Those remarks were seized upon by the Gold Anti-Trust Action Committee, a private group that contends the Fed and the Treasury secretly have been selling gold to suppress prices.

Italian Gold Coverage - Borsa & Finanza, Italy

Submitted by admin on Wed, 2001-05-23 03:00 Section: GATA in the PressItalian magazine article warns of

gold price manipulation

From Borsa & Finanza, Italy

May 2001

The U.S. Treasury is accused of manipulating the free

market. Risks for the international bourses.

By Guido Bellosta

A trial that starts in Boston affects the interest of

hundreds of thousand of savers, financiers, and miners.

On the bench is the Treasury Department of the United

Fury over the great gold sale - Daily Mail

Submitted by admin on Wed, 2001-05-23 03:00 Section: GATA in the Pressby Alex Brummer, City Editor, Daily Mail

THE GOVERNMENT plans to press ahead and complete its

sale of 60% of Britain's gold reserves by the end of

the year despite demands from senior Tories that the

auction be halted.

The price of bullion soared to around £204 an ounce

($300) on global markets this week because investors tend to

turn to gold at times of turbulence in the world

economy, seeing it as a hedge against future inflation.

GATA's Conspiracy Theory - Business Day

Submitted by admin on Mon, 2001-05-14 03:00 Section: GATA in the PressVANTAGE POINT

by ILJA GRAULICH

THEY are the $289 Club; power brokers who held the gold price to exactly $289/oz on the last trading days of 1997, 1998 and 1999.

So says the Gold Anti-Trust Action Committee (Gata). (For the record, according to the London Bullion Market Association, the prices were $289, $287 and $290 respectively).

For some, Gata members are heroes, fighting for a genuine cause —freeing the gold price from alleged manipulation. For others, they are a bunch of lunatics — entertaining, but lunatics nevertheless.

US Conspiracy Keeps Gold Price Low - Kwana News

Submitted by admin on Mon, 2001-05-14 03:00 Section: GATA in the PressSouth Africa has lost billions because of price rigging

Hilda Grobler

There is an international conspiracy to keep the price of gold below its equilibrium price. At present gold sells at $267,l0 (R2136,80) a troy ounce when it should, in fact, sell at around 5600,00 (R4 800). And they have the proof to back up this claim, said Bill Murphy, chairman of the Gold Anti-Trust Action Committee (GATA), at a summit in Durban this week.